Call: +8801919053634, +8801721053634

Some traders monitor stocks near resistance and buy once the stock experiences a breakout above resistance. A trader monitoring this stock may have bought the stock on the day of the breakout and potentially profited in the following days. A previous support level will sometimes become a resistance level when the price attempts to move back up, and conversely, a resistance level will become a support level as the price temporarily falls back. In any event, support is an area on a price chart that shows buyers’ willingness to buy. It is at this level that demand will usually overwhelm supply, causing the price decline to halt and reverse. In a downtrend, prices fall because there is an excess of supply over demand.

- Two of the most common technical analysis terms, support and resistance lines use chart patterns and price levels to determine where a downward or upward trend will likely end.

- It is up for interpretation, and different people may see things differently.

- Armed with this information, traders and investors can potentially find price levels (or price points) to enter or close a position.

- As the price reaches the support or resistance line, there are two options – it will either bounce back as forecast, or a trend is broken.

One strategy that they use is to place short trades as the price touches the upper trendline and long trades as price reverses to touch the lower trendline. This strategy is extremely dangerous, and it is much better to wait to see in which direction price will break out of the range and then place your trades in that direction. This visualization gives traders a good idea of where asset prices might move in the future. Trendlines can be used for support and resistance levels within any time frame and also show the speed of price movements and periods of price contractions. Now, to make it short and sweet before we are done, let me put it this way. Stock traders can more accurately predict future market movements by analyzing the support and resistance levels.

Drawing a Resistance Level

A break above the middle line shows strength that targets a move to the upper line. Once broken, these Speedlines can then turn into support on a pullback. Developed by Edson Gould, Speed Resistance Lines, sometimes referred to as Speedlines, are trend lines based on 1/3 and 2/3 retracements. Gould was a prominent market technician who became quite famous for his market calls in the 60s and 70s.

These are just a handful of the myriad ways to implement technical analysis in trading. The application of such tools allows for a more robust and strategic approach to understanding the movements and potential trends in the financial market. A technical indicator many traders use, moving averages smooth out past prices and can help you find areas of support and resistance. This happens when the moving averages appear to form a support line on an uptrend, and resistance line as a downtrend. You can try different moving averages to see which works best for you.

Standard deviation, a statistical measurement that shows how much variation exists from an average, plays a significant role in calculating resistance lines. By accounting for the volatility of a security’s price, standard deviation allows for more accurate determination of resistance levels. When the price volatility is high, the resistance lines tend to be farther from the moving average, and vice versa.

In this way, traders and investors can observe and follow the patterns present in stock movements to make profitable trades. These moving averages are followed by many traders, reinforcing their relevance and efficiency. On the other hand, horizontal lines are said to be static since they only consider a single price level throughout, although this may change over time.

Breakthrough

Gould appeared on Wall Street Week a few times and was often quoted in Barron’s. Speed Resistance Lines are not drawn like traditional trend lines, which are based on peaks and troughs. Instead, the first line extends from the low to the high in an uptrend or from the high to the low in a downtrend. Subsequent lines are then placed at 1/3 and 2/3 intervals to estimate potential support or resistance levels. When the stock price begins to approach the line drawn at a prior low, you can expect demand to increase as buyers anticipate a bounce higher from that point. Momentum traders and investors looking to capitalize on a trending stock might consider buying stocks near these levels.

In simple terms, support and resistance lines are used to identify when to buy and when to sell an asset, usually stocks or currencies, and at what price. These levels are usually temporary and short-lived but can also be long-lasting as markets receive new information. Support and resistance levels are two of the most common concepts in the technical https://1investing.in/ analysis used in stock trading. If you are a beginner to technical analysis, support and resistance are the first indicators to know before using other trading tools. At this point, you can expect to get an indication of the next price movement. If the price cannot break below the support level, you will buy the asset and join the trend.

Moving Averages

In particular, this line helps determine a stock’s resistance and support levels. As you know, nothing is guaranteed in the financial markets, and there is no magic way to determine future resistance. The tools mentioned above may give you a better idea of where to set price targets, but don’t solely rely on these—they may not always work. Technical analysis is one approach of attempting to determine the future price of a security or market. Some investors may use fundamental analysis and technical analysis together; they’ll use fundamental analysis to determine what to buy and technical analysis to determine when to buy. First let’s assume there are buyers who’ve been buying a stock close to a support area.

CSCO, ANET Stock Surges Past Resistance Levels; Loses 2.09% – The Coin Republic

CSCO, ANET Stock Surges Past Resistance Levels; Loses 2.09%.

Posted: Fri, 08 Sep 2023 15:29:00 GMT [source]

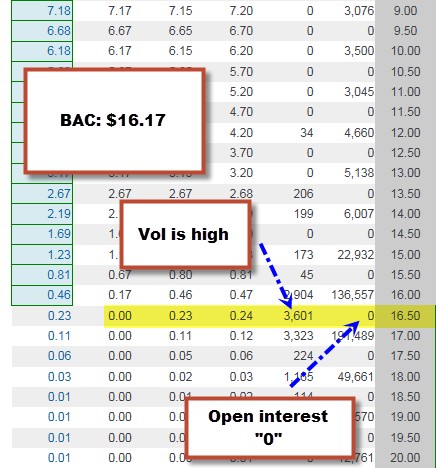

For example, the company may announce positive news that suddenly increases demand much more, and the existing support and resistance levels are no longer valid. When it comes to designing successful trading strategies, support and resistance levels are among the most important elements in the field of technical analysis. For example, a fund may decide to sell a stock when it’s up 20 percent or when it reaches a specific price. If enough investors decide to sell at the same price level, their collective selling will cause resistance. Similarly, if enough investors decide to buy once a stock has fallen a certain amount, those transactions can naturally lead to price support. Some analytical approaches involve two resistance lines indicating two different levels of possible deviations.

Identifying Resistance Levels with Trendlines

Here is another chart, where both S&R have been identified for Ambuja Cements Limited. To learn more about how to add this annotation to your charts, check out our Support Center article on ChartNotes’ Line Study Tools. Your pop-up blocker may be preventing MarketSmith charts from opening.

Based on where this line fits in concerning the current market price, it either becomes support or resistance. The next obvious question is, how do we identify the resistance level? Identifying price points as either a support or resistance is extremely simple. The identification process is fte role meaning the same for both support and resistance. If the current market price is below the identified point, it is called a resistance point; else it is called a support point. When the two prices meet, consolidation between support and resistance – called support and resistance reversal happens.

Being able to accurately determine these two levels is important to improve the profitability of trades and your short-term trading strategy. Highlighting support and resistance levels with trendlines can help to identify the overall price trend and direction. This can be highlighted on the chart using straight lines that connect together several price points. Traders can use support and resistance levels to determine whether to buy or sell; here’s a simple example to understand the concept of these two lines and how they are used by traders.

Reading Speed Resistance Lines

The lower prices go, the more attractive prices become to those waiting on the sidelines to buy the shares. At some level, demand that would have been slowly increasing will rise to the level where it matches supply. Traders who went short ahead of the resistance on speculation will be looking to buy back once the anticipated down move looks like it is about to end, or does end. For example here is a chart where two price action zones are identified, but they are not at the same price point.

If the price moves in the wrong direction (breaks through prior support or resistance levels), the position can be closed at a small loss. If the price moves in the right direction (respects prior support or resistance levels), however, the move may be substantial. Resistance levels can be identified through technical analysis of charts and the various tools that come with them. Among the favorite tools used to identify resistance levels are key highs, trendlines, moving averages (simple and exponential), Bollinger Bands, and Ichimoku Cloud charts.

For example, as you can see from the Newmont Corp. (NEM) chart below, a trendline can provide support for an asset for several years. In this case, notice how the trendline propped up the price of Newmont’s shares for an extended period of time. Support refers to the price level on a chart where equilibrium is reached. This causes the decline in the price of the asset to halt; therefore, price has reached a price floor.

- However, you might find that after reading up more, the concept is slightly more difficult to grasp as these levels can come in many different forms.

- You can learn more about how to use support and resistance zones in a trading strategy in our article “Support and Resistance Stock Screener and Trading Strategies”.

- Resistance in the stock market refers to a phenomenon where selling at a certain price level prevents a stock from exceeding that price.

- When a stock approaches its prior high it creates an interesting psychological impact.

By studying these two levels, stock traders and investors (and other market participants) can better understand what is happening in the stock market and find many trading opportunities. It’s all about price action and those price drops, price breaks, and price highs! Further, remember that support and resistance price levels tend to be round numbers or near them.